Common Blockers to Getting Your Marketing Mix Modelling (MMM) Program Up and Running

Common Blockers to Getting Your Marketing Mix Modelling (MMM) Program Up and Running

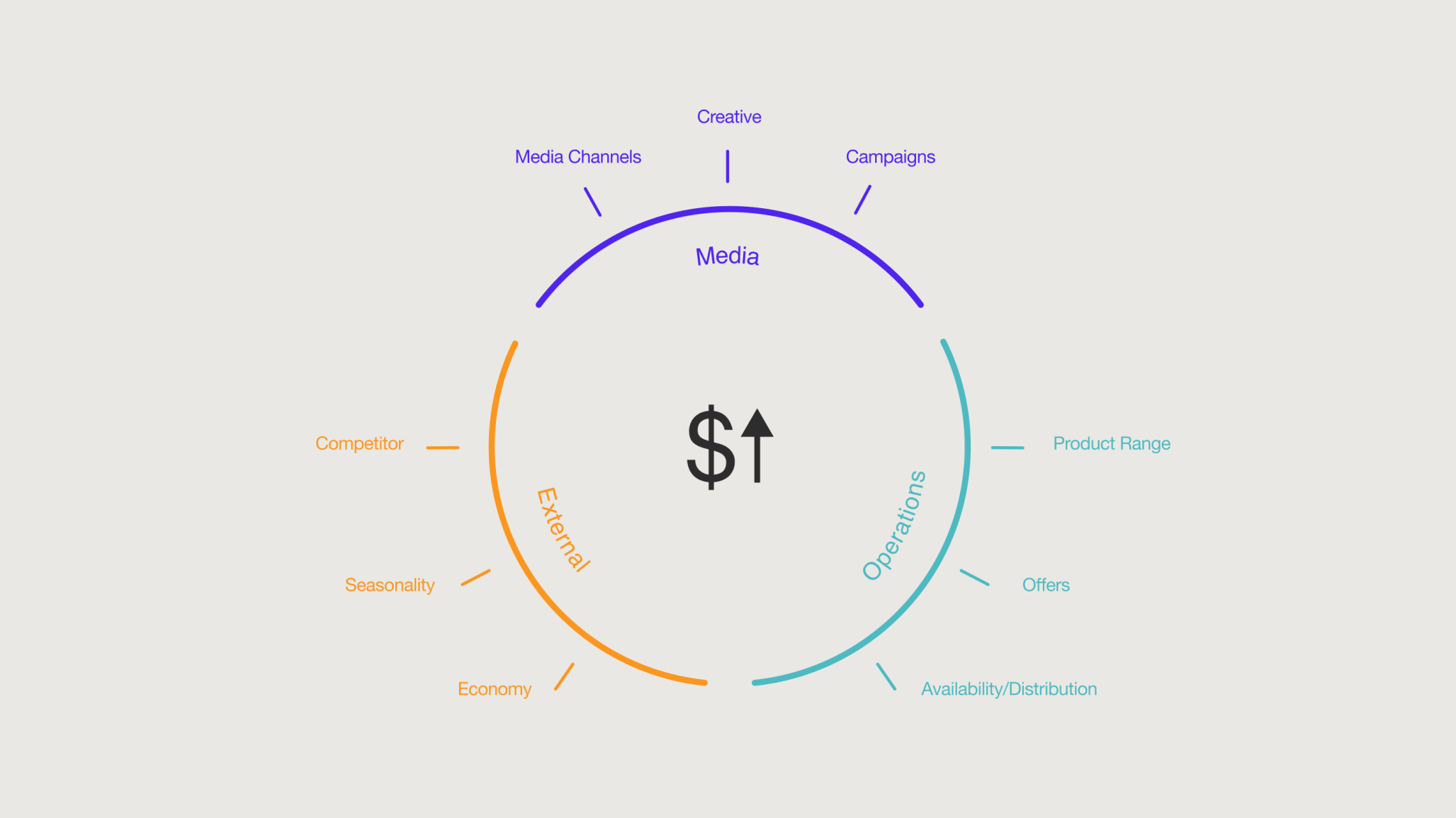

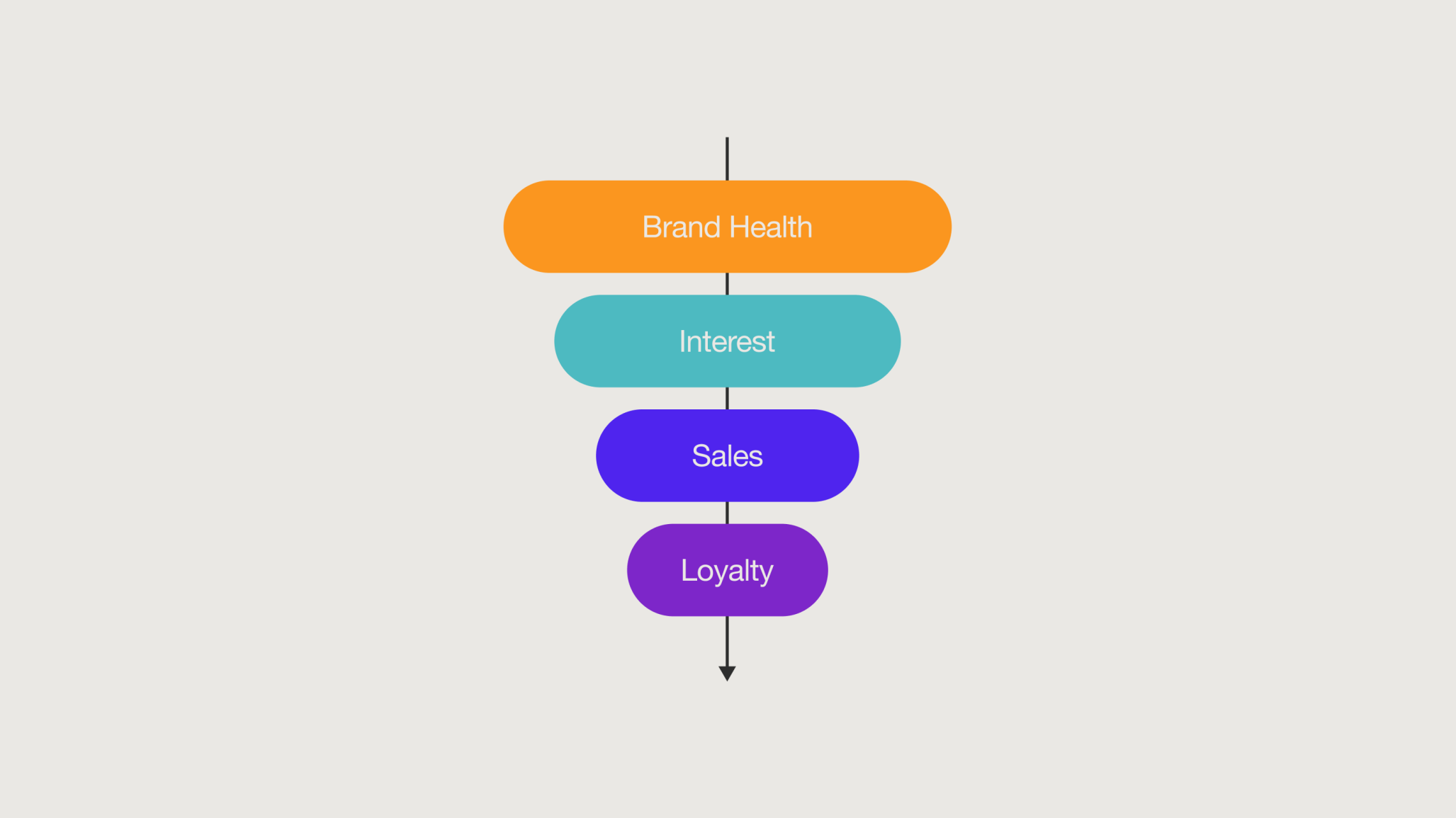

Launching a Marketing Mix Modeling (MMM) program can significantly enhance your marketing strategies and provide a robust framework to measure success. However, many organizations face substantial hurdles. Here are some common blockers that can impede your efforts and suggestions to overcome them.

Analytics seem overly complex and not fully trustworthy.

Perceptions around analytics can be a hurdle. Many view it as a black box, lacking transparency and trustworthiness, and may think it’s merely retrospective with no actionable insights.

This is not the case. In fact, analytics can be highly effective when approached correctly. What you need is the right supplier. Look for one that offers transparency, expertise in developing robust MMM, and the ability to translate these models into actionable recommendations. Ultimately, the value lies in insights and recommendations rather than the models themselves.

Insufficient budget or resource allocation.

The cost associated with MMM can often seem overwhelming. Many businesses do not allocate sufficient funds in their annual budgets, which can stall or completely halt the implementation of an MMM program.

To overcome this, start small and focus on your main objectives initially. Use this to build a case for increased budgets over time. Leverage existing resources and identify any open-source tools to build MMM, and work with suppliers to provide data in a pre-agreed format, which can often help reduce fees.

Uncertainty of when is the right time to start.

Timing is critical. With new campaigns always on the horizon, it's tempting to delay MMM analysis to include the next campaign, wait for full-year numbers, or incorporate the upcoming product launch. There is always something upcoming and this can lead to a cycle of postponement.

In short, don’t delay. Begin the process as soon as possible. Early insights and recommendations can lead to impactful business changes. Over time, your MMM will evolve and you can always update the analysis to include future activities. The value from initial findings often outweighs the reasons for waiting.

Concerns about data quality and accuracy.

Quality data is the foundation of any successful MMM program. Questions about data availability can cause hesitation, as the adage "garbage in, garbage out" holds true.

Conduct a data audit, as the quality of the data remains unknown until it’s reviewed. Set up checkpoints during the analysis to determine data fitness, and if it falls short, create a plan to collect fit-for-purpose data. Focus on using the data that is available. Generate initial insights with whatever data you have, then enhance the MMM with more data over time. Don't wait for perfection to begin gaining insights. Look for continuous improvements, and remember that better data leads to better decisions. Improving data quality is an ongoing process.

Fear of undesirable results.

Fear of discovering negative outcomes can be paralyzing. Concerns about campaign performance or potential budget reallocations may deter businesses from pursuing an MMM program.

Acknowledge the risks and treat this as an education. Working in ignorance is one thing, but remaining deliberately uninformed is unacceptable. Embrace the process and be prepared to make data-informed decisions.

Addressing these common blockers is essential for the successful implementation of an MMM program. Finding the right scope to meet your budget and a trusted MMM partner are the best next steps to creating valuable insight and actionable recommendations to drive business performance.